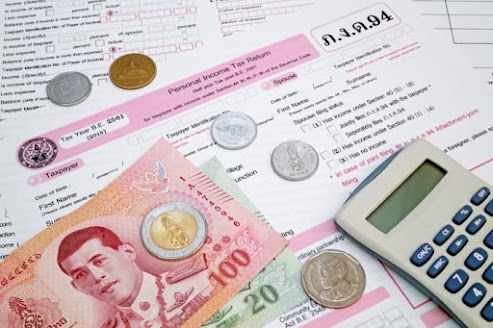

A new reality is dawning for expats in Thailand.

A significant overhaul of the Thai tax system, effective January 1st, 2024, has thrown a curveball at the expat community, raising concerns and prompting a scramble for solutions.

This article delves into the intricacies of this new tax tango, offering a roadmap for expats to navigate the complexities and unlock potential strategies to secure their financial future in the Land of Smiles.

Previously a haven for foreign income, Thailand’s tax code offered a sweet deal to expats:

Foreign earnings stashed abroad remained blissfully untaxed. However, the new year has ushered in a paradigm shift. Now, all foreign earned income brought into Thailand by tax residents, including expats, is subject to personal income tax. This marks a significant departure from the past, leaving many expats wondering how to navigate this uncharted territory.

Understanding the Old and the New:

To grasp the full impact of the changes, let’s rewind to the pre 2024 era. Expats enjoyed the freedom of keeping their foreign income untaxed as long as it remained outside Thailand. Income earned and brought into the country within the same year was subject to tax, but passive income like pensions and investments from abroad existed in a grey area, with no clear guidelines.

Fast forward to 2024, and the landscape has transformed. The new law dictates that all foreign earned income remitted to Thailand by tax residents is subject to personal income tax.

Full Story: HUA HIN TODAY